Home Equity Loan

Get Cash from your home

EXCELLENTTrustindex verifies that the original source of the review is Google. I had the pleasure of working with Victor Santos, and he truly exceeded expectations on a recent purchase transaction. Despite the Builder offering an $8k incentive with their own mortgage rates, Victor and Onpoint Mortgage Pro provided a competitive rate that not only beat the Builder’s offer but also allowed us to close smoothly and on time. We had a tight deadline—just 11 working days on a newly built home—but Victor was up for the challenge. My clients are beyond happy with the seamless experience and grateful for the efficiency that made this process stress-free. I highly recommend Victor for anyone in need of a dedicated and reliable mortgage professional!Posted onTrustindex verifies that the original source of the review is Google. I just refinanced my home and the process was smooth, fast, and stress-free. Victor was professional, responsive, and made everything incredibly easy. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. Victor was truly a pleasure to work with. He demonstrated exceptional availability and expertly recommended the optimal solution for my refinance. His professionalism and depth of knowledge were greatly appreciated. Thank you!Posted onTrustindex verifies that the original source of the review is Google. 21/10 - Incredible, seamless and informative experience with Victor! FYI, We live in Texas, and he's in Cali. Buying or refinancing a home can be stressful since a lot of people don't understand the process and get lost in the paperwork. Victor took the time to get to know us, what we were looking for and provided so much information and practically educated us on 5 different options that would be beneficial for us! He helped us lock in the rates we were absolutely comfortable with and that's more important to a customer! Thank you, Victor for going above and beyond for us.Posted onTrustindex verifies that the original source of the review is Google. We praise God first of all for putting Victor Santos in our life at the right time when we were looking not only to lower our interest rates and monthly payments but also help us to navigate through all the confusion from all the other agents and brokers that just wanted our business.Victor was very patient and humble and honest as he explained all the details and even called us to remind us of incoming e-mails .God continue to keep Victor humble, patient and honest with all his clients. I will recommend Victor to anyone who is looking to refinance their home and property. God Bless Victor and his family always.Posted onTrustindex verifies that the original source of the review is Google. Victor was awesome during the financing process. He spent an ample amount of time teaching and helping us understand everything. We will strongly recommend him to others!Posted onTrustindex verifies that the original source of the review is Google. We did FHA streamline refinance with Victor and It was an awesome experience working with him.. Process was smooth and fast! Victor is knowledgeable and very professional. Our team to go for all future needs👍🏻Posted onTrustindex verifies that the original source of the review is Google. We truly appreciate Victor’s constant availability and how responsive he was every step. No matter the time or day, he was always there to answer our questions and provide clear, honest advice. Thank you again for your dedication and support — we’re so grateful to have worked with you for the 3rd time!Posted onTrustindex verifies that the original source of the review is Google. Victor at OnPoint Mortgage Pro made buying my first home an stress-free experience. He explained everything clearly, kept me updated, and even helped me close a month early. He went above and beyond to secure the best rates and made the whole process seamless. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. I had an excellent experience working with Victor from OnPoint Mortgage Pro. He met with me and my client, explained the entire funding process, and went above and beyond to research the best program for my client, a first-time homebuyer. Victor not only beat the builder’s in-house lender and the bank on rates, but he also delivered exceptional personalized service. He was always available, highly knowledgeable, and communicated consistently throughout the process. He even shared valuable insights with my client, which was greatly appreciated. Victor managed everything in a timely and transparent way, keeping constant communication with the builder to ensure we stayed on track. Both my client and I were extremely happy with his service. He was thorough, professional, and truly cared about making the experience smooth and stress-free. I highly recommend Victor if you are working with buyers—you will have peace of mind knowing they are in great hands.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

What cash-out option is better for me?

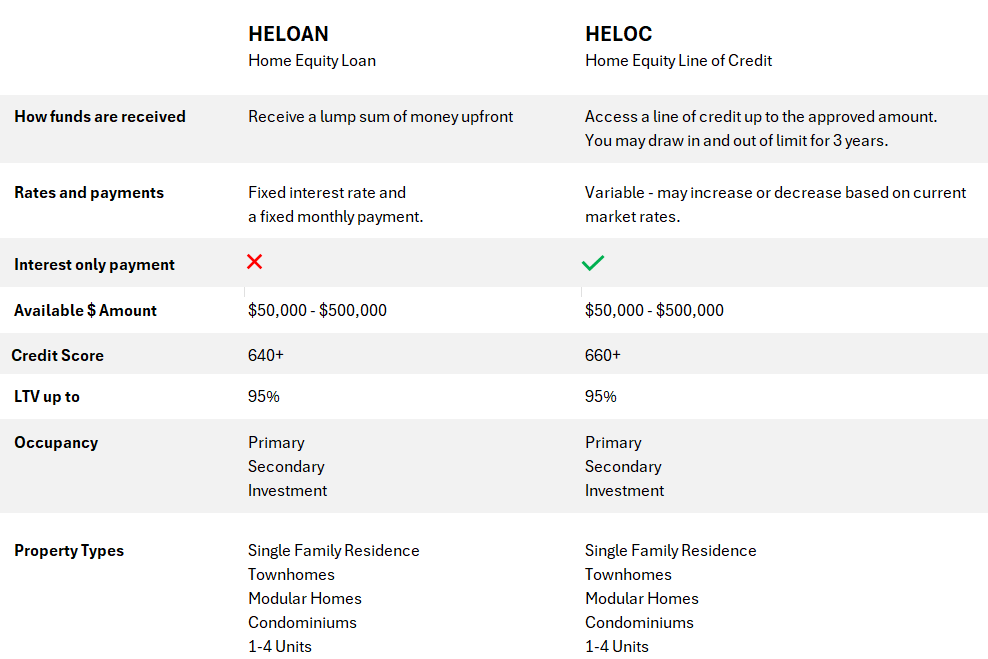

Need to tap into the value of your home? Two loan options can help: the Home Equity Loan (HELOAN) and the Home Equity Line of Credit (HELOC). Both unlock your home equity for your needs, but they work differently. Let’s break down the key distinctions!

Frequently Asked Questions

What is a Home Equity Loan?

Think of a home equity loan as getting a chunk of change upfront from your home. It’s different from a HELOC because you receive a one-time lump sum and start paying it back right away with fixed monthly payments that cover both the interest and the loan principal.

What is a HELOC?

Imagine a HELOC (Home Equity Line of Credit) as a credit card for your home. Just like a credit card, you have a set spending limit based on your home’s equity. You can withdraw money whenever you need it, and during the initial draw period, you’ll only pay interest on the amount you borrow. This lets you manage your finances and only pay for what you use.

Should I refinance my current mortgage, instead?

Hold on to your sweet mortgage rate! A cash-out refinance replaces your current mortgage with a new one, potentially wiping out that incredible interest rate you snagged. For many homeowners, this wouldn’t be ideal. That’s where HELOCs and home equity loans come in – they allow you to access your home equity without sacrificing your existing mortgage.

Where can I use the money?

Need money for that dream renovation, your child’s college tuition, or unexpected medical bills? HELOCs and home equity loans can unlock the equity in your home and turn it into cash for various goals. Think of it like an ATM for your home, giving you the flexibility to cover expenses, consolidate high-interest debt, or even secure a down payment on a new place while you sell your current one.

How much equity can I get?

Some lenders might offer home equity loans with a loan-to-value (LTV) ratio as high as 95%. This means you could potentially borrow a larger sum of money based on your home’s value. Let’s say your home is appraised at $700,000 and you still owe $400,000 on your mortgage. With a 95% LTV, you might qualify for a home equity loan of up to $265,000 ($700,000 x 95% – $400,000).

EXCELLENTTrustindex verifies that the original source of the review is Google. I had the pleasure of working with Victor Santos, and he truly exceeded expectations on a recent purchase transaction. Despite the Builder offering an $8k incentive with their own mortgage rates, Victor and Onpoint Mortgage Pro provided a competitive rate that not only beat the Builder’s offer but also allowed us to close smoothly and on time. We had a tight deadline—just 11 working days on a newly built home—but Victor was up for the challenge. My clients are beyond happy with the seamless experience and grateful for the efficiency that made this process stress-free. I highly recommend Victor for anyone in need of a dedicated and reliable mortgage professional!Posted onTrustindex verifies that the original source of the review is Google. I just refinanced my home and the process was smooth, fast, and stress-free. Victor was professional, responsive, and made everything incredibly easy. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. Victor was truly a pleasure to work with. He demonstrated exceptional availability and expertly recommended the optimal solution for my refinance. His professionalism and depth of knowledge were greatly appreciated. Thank you!Posted onTrustindex verifies that the original source of the review is Google. 21/10 - Incredible, seamless and informative experience with Victor! FYI, We live in Texas, and he's in Cali. Buying or refinancing a home can be stressful since a lot of people don't understand the process and get lost in the paperwork. Victor took the time to get to know us, what we were looking for and provided so much information and practically educated us on 5 different options that would be beneficial for us! He helped us lock in the rates we were absolutely comfortable with and that's more important to a customer! Thank you, Victor for going above and beyond for us.Posted onTrustindex verifies that the original source of the review is Google. We praise God first of all for putting Victor Santos in our life at the right time when we were looking not only to lower our interest rates and monthly payments but also help us to navigate through all the confusion from all the other agents and brokers that just wanted our business.Victor was very patient and humble and honest as he explained all the details and even called us to remind us of incoming e-mails .God continue to keep Victor humble, patient and honest with all his clients. I will recommend Victor to anyone who is looking to refinance their home and property. God Bless Victor and his family always.Posted onTrustindex verifies that the original source of the review is Google. Victor was awesome during the financing process. He spent an ample amount of time teaching and helping us understand everything. We will strongly recommend him to others!Posted onTrustindex verifies that the original source of the review is Google. We did FHA streamline refinance with Victor and It was an awesome experience working with him.. Process was smooth and fast! Victor is knowledgeable and very professional. Our team to go for all future needs👍🏻Posted onTrustindex verifies that the original source of the review is Google. We truly appreciate Victor’s constant availability and how responsive he was every step. No matter the time or day, he was always there to answer our questions and provide clear, honest advice. Thank you again for your dedication and support — we’re so grateful to have worked with you for the 3rd time!Posted onTrustindex verifies that the original source of the review is Google. Victor at OnPoint Mortgage Pro made buying my first home an stress-free experience. He explained everything clearly, kept me updated, and even helped me close a month early. He went above and beyond to secure the best rates and made the whole process seamless. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. I had an excellent experience working with Victor from OnPoint Mortgage Pro. He met with me and my client, explained the entire funding process, and went above and beyond to research the best program for my client, a first-time homebuyer. Victor not only beat the builder’s in-house lender and the bank on rates, but he also delivered exceptional personalized service. He was always available, highly knowledgeable, and communicated consistently throughout the process. He even shared valuable insights with my client, which was greatly appreciated. Victor managed everything in a timely and transparent way, keeping constant communication with the builder to ensure we stayed on track. Both my client and I were extremely happy with his service. He was thorough, professional, and truly cared about making the experience smooth and stress-free. I highly recommend Victor if you are working with buyers—you will have peace of mind knowing they are in great hands.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more