Shop Top 20 Wholesale Lenders

Purchase

4.875% (5.4%APR)

VA 30-Year Fixed Rate

Rate Reduction

5.0% (5.2%APR)

VA 30-Year Fixed Rate

Cash – Out

5.125% (5.5%APR)

VA 30-Year Fixed Rate

*Scenario: loan amount of $400,000-660 FICO-95%LTV- SFR-CA

Compare Our Rates To The National Average Below

Check Out Our Customer Reviews

EXCELLENTTrustindex verifies that the original source of the review is Google. Victor Santos did a fantastic job helping us get a 1.5% rate reduction. He was quick to respond to any question at all hours of the day and stood by us through every step of the process. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Victor was really helpful with my refinance application. He picked up my phone anytime during the day. I was asking him lot of questions, and answered all those with ease and smile. He is so professional and fast. I recommend him to anyone and Offcourse I will give his name to my family members. recently victor helped me get secodn mortgage in jan 2026 with zero closing cost. He is nice and will answer any questions, multiple times a day. He will save you money.Posted onTrustindex verifies that the original source of the review is Google. I had the pleasure of working with Victor Santos, and he truly exceeded expectations on a recent purchase transaction. Despite the Builder offering an $8k incentive with their own mortgage rates, Victor and Onpoint Mortgage Pro provided a competitive rate that not only beat the Builder’s offer but also allowed us to close smoothly and on time. We had a tight deadline—just 11 working days on a newly built home—but Victor was up for the challenge. My clients are beyond happy with the seamless experience and grateful for the efficiency that made this process stress-free. I highly recommend Victor for anyone in need of a dedicated and reliable mortgage professional!Posted onTrustindex verifies that the original source of the review is Google. I just refinanced my home and the process was smooth, fast, and stress-free. Victor was professional, responsive, and made everything incredibly easy. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. Victor was truly a pleasure to work with. He demonstrated exceptional availability and expertly recommended the optimal solution for my refinance. His professionalism and depth of knowledge were greatly appreciated. Thank you!Posted onTrustindex verifies that the original source of the review is Google. 21/10 - Incredible, seamless and informative experience with Victor! FYI, We live in Texas, and he's in Cali. Buying or refinancing a home can be stressful since a lot of people don't understand the process and get lost in the paperwork. Victor took the time to get to know us, what we were looking for and provided so much information and practically educated us on 5 different options that would be beneficial for us! He helped us lock in the rates we were absolutely comfortable with and that's more important to a customer! Thank you, Victor for going above and beyond for us.Posted onTrustindex verifies that the original source of the review is Google. We praise God first of all for putting Victor Santos in our life at the right time when we were looking not only to lower our interest rates and monthly payments but also help us to navigate through all the confusion from all the other agents and brokers that just wanted our business.Victor was very patient and humble and honest as he explained all the details and even called us to remind us of incoming e-mails .God continue to keep Victor humble, patient and honest with all his clients. I will recommend Victor to anyone who is looking to refinance their home and property. God Bless Victor and his family always.Posted onTrustindex verifies that the original source of the review is Google. We truly appreciate Victor’s constant availability and how responsive he was every step. No matter the time or day, he was always there to answer our questions and provide clear, honest advice. Thank you again for your dedication and support — we’re so grateful to have worked with you for the 3rd time!Posted onTrustindex verifies that the original source of the review is Google. Victor at OnPoint Mortgage Pro made buying my first home an stress-free experience. He explained everything clearly, kept me updated, and even helped me close a month early. He went above and beyond to secure the best rates and made the whole process seamless. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. I had an excellent experience working with Victor from OnPoint Mortgage Pro. He met with me and my client, explained the entire funding process, and went above and beyond to research the best program for my client, a first-time homebuyer. Victor not only beat the builder’s in-house lender and the bank on rates, but he also delivered exceptional personalized service. He was always available, highly knowledgeable, and communicated consistently throughout the process. He even shared valuable insights with my client, which was greatly appreciated. Victor managed everything in a timely and transparent way, keeping constant communication with the builder to ensure we stayed on track. Both my client and I were extremely happy with his service. He was thorough, professional, and truly cared about making the experience smooth and stress-free. I highly recommend Victor if you are working with buyers—you will have peace of mind knowing they are in great hands.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

What is a VA Loan?

Thinking about buying a home or refinancing your mortgage? If you’re a Veteran, service member, or surviving spouse, a VA loan could be a great option for you. Backed by the government, VA loans come with competitive interest rates and flexible terms.

You can use a VA loan to purchase various types of properties, including single-family homes, condos, townhouses, and even new construction. When rates drop you are able to refinance your mortgage on a streamline process to take advantage of a lower rate and payment.

Here’s the catch: While the VA guarantees the loan, you won’t get it directly from them. Instead, you’ll work with a private lender like a bank or a mortgage lender.

VA Loan Benefits

More than just a mortgage option, VA loan, established in 1944, have empowered over 28 million veterans with homeownership opportunities by offering similar terms to conventional loans with added advantages.

Unlock The Power Of VA Loans!

Here are some of the biggest advantages than can help you achieve homeownership.

0% Down Payment

Skip the Down Payment

VA loans are designed to be accessible for Veterans and service members to buy a home without a down payment.

This can be a huge advantage compared to other loans, where saving for a down payment can take years.

VA buyers with cash saved up can put those funds towards other things like renovations or closing costs.

Lower Rates

Unlocking Bigger Dreams

VA loans have boasted the lowest average interest raes on the market, according to Optimal Blue, for at least the past two years.

No Mortgage Insurance

Skip the Extras and Stretch Your Budget

Unlike conventional loans that often require PMI (private mortgage insurance) if you can’t put 20% down, or FHA loans with their own mortgage insurance, VA loans eliminate these extra costs.

This translates to significant savings for Veterans, allowing them to stretch their homebuying budget further and purchase a home that might otherwise be out of reach.

Minimized Closing Costs

- Limited Origination Fees: Unlike some lenders, VA lenders have capped fees for processing your loan, saving you money upfront.

- Seller Support: In a VA transaction, the seller can cover all your loan-related closing costs and even contribute up to 4% of the loan amount towards your closing expenses!

- Reduced Out-of-Pocket Costs: VA also restricts the fees you, the buyer, are responsible for, further reducing your financial burden.

Flexible Credit Underwriting

Open the door to homeownership with less-than-perfect-credit!

VA Loans offer more flexibility with credit scores, debt-to-income ratios, and waiting periods after negative credit events. This makes them a powerful tool for Veterans and service members to achieve their dream of homeownership.

VA Loan Rates

VA IRRRL rates consistently rank among the most competitive mortgage options available. This is largely thanks to the government backing provided by the Department of Veterans Affairs, which allows the lenders to offer exceptionally attractive interest rates on these loans.

VA Loan Eligibility

VA home loans are open to veterans, active duty service member, and some National Guard and Reserve members, as well as certain eligible spouses.

You are eligible for a VA loan if you served:

- 90 consecutive days on active duty during wartime

- 181 consecutive days on active duty during peacetime

- 6 years in the National Guard or Reserves, or 90 days under Title 32 orders (with at least 30 consecutive days)

In some cases, veterans discharged under certain conditions and surviving spouses of service members may also qualify.

While veterans don’t necessarily need a Certificate of Eligibility (COE) to start the home loan process, obtaining one is a crucial step. This formal document, issued by the Department of Veterans Affairs, confirms you meet the VA’s guidelines.

Skip the guess work, Onpoint Mortgage Pro, can often assist you in obtaining your COE.

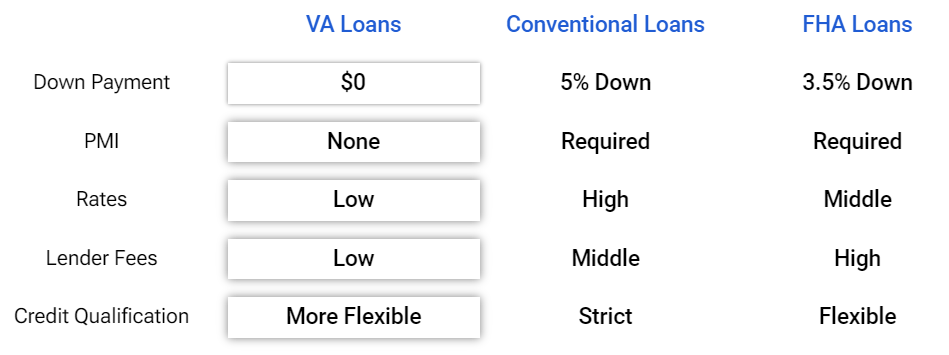

Comparing VA Loans

All mortgage types have their pros and cons, but VA loans often stand out for veterans and military homebuyers due to their unique benefits.

These benefits can include potentially lower credit score requirements, possibility of $0 down payment and often lower rates. Let’s see how VA loans compare to conventional and FHA loans.

Understanding all of your mortgage options is key to making the best financial decision possible. Just because you’re a Veteran doesn’t mean a VA loan is automatically the right fit. But for many Veterans and service members, this government-backed program offers significant advantages, potentially including lower credit score requirements, no down payment options, and competitive interest rates.

While VA loans offer many advantages, there can be limitations on property types and funding fees to consider. A VA loan specialist can help you evaluate all your mortgage options and determine if a VA loan is the right fit for you. Learn more about VA loans and see if they might be right for you.

Types of VA Loans

There are multiple powerful home financing options available to qualified Veterans

VA Purchase

Great news for Veterans and service members! You can use a VA loan to buy your dream home, even with no money down. VA purchase loans are versatile and can be used for various property types, including:

- Single-family homes

- Condominiums

- Manufactured homes

- Multiunit properties (like duplexes)

- New construction

Keep in mind: While VA loans offer these options, it’s important to remember that lenders may have different policies. Some lenders might not offer all the mentioned VA purchase loan types. It’s always best to check with your preferred lender to see what they have available.

VA Rate Reduction Refinance

Want to save money on your existing VA home loan? The VA Interest Rate Reduction Refinance Loan (IRRRL), also called a VA Streamline, is a popular option for Veterans to do just that.

These streamlined refinancings are known for being fast and affordable. In some cases, they might even skip credit checks, income verification, and appraisals. However, there are a few key requirements:

- You must already have a VA loan on the property.

- Your new interest rate needs to be lower than your current one.

- There are limits on how long it can take to recoup the closing costs associated with the refinance.

These requirements help ensure Veterans benefit financially from the lower interest rate.

VA Cash-Out Refinance

Unlock the equity in your home with a VA Cash-Out Refinance! This program allows qualified Veterans, even those without existing VA loans, to turn their home equity into cash. Typically, you can refinance up to 90% of your home’s value.

Here’s the flexibility:

- You can use the cash for anything you need, like home improvements, debt consolidation, or even educational expenses.

- Not interested in taking cash out? No problem! This program can also be used simply to get a lower interest rate or adjust your loan term, even if you have a non-VA mortgage currently.

Remember: Loan details and maximum cash-out amounts can vary by lender. Be sure to check with your preferred lender to see what options they offer.

VA Energy Efficient Mortgage

Save on energy bills and improve your home’s comfort with a VA Energy Efficient Mortgage!

Veterans can use a VA EEM to borrow up to an additional $6,000 to finance energy-saving upgrades to their home. This can be done either when purchasing a new home or refinancing an existing VA loan.

Here are some of the improvements you can cover with this program:

- Storm or thermal windows

- Heat pumps

- Solar heating and cooling systems

Keep in mind: This program is designed for permanent improvements that can significantly reduce your energy consumption. It cannot be used for appliances, window air conditioners, or other temporary additions.

VA Loan FAQs

For generations, VA loans have been a cornerstone of financial security for Veterans and military families. This proven benefit has helped countless heroes achieve their dream of homeownership.

Ready to learn more? We’ve compiled answers to some of the most frequently asked questions about VA loans to help you get started.

Why choose a VA loan over a Conventional Loan?

Lower upfront costs: VA loans typically allow for no down payment, while conventional loans often require a down payment of at least 3%. This can save you a significant amount of money upfront.

No private mortgage insurance (PMI): Conventional loans usually require PMI if your down payment is less than 20%. VA loans eliminate this extra cost.

Potentially easier to qualify: VA loans may have more flexible credit score requirements and allow for higher debt-to-income ratios compared to conventional loans.

Competitive interest rates: VA loans generally offer lower interest rates than conventional loans.

What is the downside to a VA Loan?

VA loans offer significant advantages for veterans, but there are also some downsides to consider:

VA Funding Fee: Unlike conventional loans that might require PMI (private mortgage insurance), VA loans have a mandatory VA funding fee. This fee helps the government offset the program’s costs. The amount varies depending on factors like your down payment, loan type, and veteran status (first-time use vs. subsequent use). While you can finance the fee into the loan, it adds to the overall cost of borrowing.

Tighter Occupancy Requirements: VA loans are designed to help veterans purchase homes they will live in as their primary residence. This means you can’t use a VA loan for investment properties or vacation homes.

Stricter Appraisal Standards: VA appraisals ensure the property meets minimum safety and habitability standards. These standards can be stricter than conventional appraisals, potentially limiting your options or impacting the closing timeline.

Less Equity Buildup with No Down Payment: While the zero-down payment option is a major advantage, it also means you’ll have less equity in your home initially. This can impact your ability to leverage your home equity for future loans.

Lender Variations: While VA loans have set guidelines, lenders may have their own policies and restrictions. It’s important to compare lenders to ensure you get the best terms and loan options available.

Overall, VA loans are a powerful tool for veterans to achieve homeownership. However, by understanding the downsides, you can make an informed decision about whether a VA loan is the right fit for your specific situation.

Are VA loans risky?

Here’s the truth about VA loans and down payments: For years, there’s been a misconception that low or no-down payment loans are risky. But the facts tell a different story. According to data from the Mortgage Bankers Association, VA loans have actually been one of the safest loan options available for the past 15 years!

There are a couple of key reasons behind this:

- Focus on Financial Stability: VA loans go beyond just a credit score. They consider a borrower’s residual income, meaning your ability to manage monthly expenses. This ensures Veterans have the financial flexibility to handle their mortgage payments.

- Supportive Resources: The VA loan program doesn’t stop at funding. They also offer supplemental loan servicing, which means they work with borrowers facing difficulties to find solutions and avoid foreclosure.

These efforts have helped countless Veterans stay on track with their mortgages and keep their homes. So, if you’re a Veteran considering homeownership, a VA loan with its low down payment option can be a smart and secure path to achieving your dream.

What is a VA funding fee?

Understanding the VA Funding Fee:

The VA Funding Fee is a one-time cost associated with most VA loans. It’s set by Congress and helps fund the entire VA loan program.

How much is the fee?

- First-time use: Great news! If it’s your first time using a VA loan for a purchase or cash-out refinance, the fee is only 2.15% of your loan amount.

- Subsequent uses: For veterans who have already used their VA benefit, the fee goes up slightly to 3.3% of the loan amount for purchases or cash-out refinances.

- VA Streamline refinancing: Streamline refis are designed to be quick and affordable, so the funding fee is a lower flat rate of 0.5%.

Here are some ways to manage the VA Funding Fee:

- Make a down payment: Putting money down can reduce the loan amount, which in turn lowers the funding fee you pay.

- Finance the fee: You can include the funding fee in your loan amount, so you don’t need to pay it upfront.

- Negotiate with the seller: In some cases, sellers might be willing to cover the VA Funding Fee as part of the closing costs.

- Exemptions: Veterans receiving disability compensation and some others are exempt from the funding fee entirely.

By understanding these options, you can factor the VA Funding Fee into your home loan planning.

How much is the VA funding fee?

The VA funding fee is not set daily and has fixed rates depending on the situation. As of today, May 17, 2024, here’s a breakdown of the VA funding fee:

- First-time use (purchase or cash-out refinance): 2.15% of the loan amount

- Subsequent uses (purchase or cash-out refinance): 3.3% of the loan amount

- VA Streamline refinance: 0.5% of the loan amount

It’s important to note that these are the current rates, but they can be changed by Congress.

Do I have to pay a VA funding fee?

You won’t have to pay a VA funding fee if any of these descriptions are true for you:

- You’re receiving VA compensation for a service-connected disability, or

- You’re eligible to receive VA compensation for a service-connected disability, but you’re receiving retirement or active-duty pay instead, or

- You’re receiving Dependency and Indemnity Compensation (DIC) as the surviving spouse of a Veteran, or

- You’re a service member who has received a proposed or memorandum rating before the loan closing date that says you’re eligible to get compensation because of a pre-discharge claim, or

- You’re a service member on active duty who, before or on the loan closing date, provides evidence of having received the Purple Heart

Is there a VA Loan Amount Limit?

Full Entitlement vs. Diminished Entitlement:

Full Entitlement: Veterans with full entitlement can generally borrow as much as they qualify for, without a down payment. This is a great benefit for first-time homebuyers using a VA loan.

Diminished Entitlement: There are situations where your full entitlement might be reduced. This could happen if you have an existing VA loan or defaulted on one in the past.

How Limits Apply with Less Entitlement:

VA Loan Limits Kick In: If you have diminished entitlement, VA loan limits come into play. These limits, set by the government, are the same as conforming loan limits for your area. They basically establish a maximum loan amount without a down payment.

Certificate of Eligibility and Down Payment: The VA calculates your remaining entitlement based on the limits and your Certificate of Eligibility (COE). This helps lenders determine if you’ll need a down payment to cover the difference between the loan amount and the limit.

The Bottom Line:

VA loans are a powerful tool, but understanding entitlement and loan limits is crucial. If you’re unsure about your eligibility or need help navigating the process, don’t hesitate to contact a VA loan specialist. They can help you determine your entitlement status and explore your financing options.

Why does my COE only show $36,000 entitlement?

This line on your COE is information for your lender. It shows that you have full entitlement.

The $36,000 isn’t the total amount you can borrow. Instead, it means that if you default on a loan that’s under $144,000, the VA guarantees to your lender up to $36,000.

For loans over $144,000, the VA guarantees to your lender will pay up to 25% of the loan amount.

How do I get a VA Loan?

Unleash the Power of Your VA Loan Benefit!

VA loans offer incredible benefits for Veterans, but getting the most out of them requires working with the right lender. Here’s how to get started:

Partner with a VA Loan Specialist: Find a trusted lender who understands the ins and outs of VA loans. Their expertise can ensure you navigate the process smoothly and maximize your benefit.

Pre-Approval: Your Key to Homeownership:

Getting pre-approved is a fast and easy step that can significantly boost your homebuying journey. Many lenders now offer pre-approval processes you can complete in minutes using your phone, laptop, or tablet.

Why Pre-Approval Matters:

- Know Your Budget: Pre-approval clarifies your buying power, so you can focus on homes that realistically fit your finances.

- Stand Out to Sellers: A pre-approval letter shows sellers you’re a serious buyer and strengthens your offer.

Taking the first step toward your dream home is easier than ever. Get pre-approved for a VA loan today!

EXCELLENTTrustindex verifies that the original source of the review is Google. Victor Santos did a fantastic job helping us get a 1.5% rate reduction. He was quick to respond to any question at all hours of the day and stood by us through every step of the process. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Victor was really helpful with my refinance application. He picked up my phone anytime during the day. I was asking him lot of questions, and answered all those with ease and smile. He is so professional and fast. I recommend him to anyone and Offcourse I will give his name to my family members. recently victor helped me get secodn mortgage in jan 2026 with zero closing cost. He is nice and will answer any questions, multiple times a day. He will save you money.Posted onTrustindex verifies that the original source of the review is Google. I had the pleasure of working with Victor Santos, and he truly exceeded expectations on a recent purchase transaction. Despite the Builder offering an $8k incentive with their own mortgage rates, Victor and Onpoint Mortgage Pro provided a competitive rate that not only beat the Builder’s offer but also allowed us to close smoothly and on time. We had a tight deadline—just 11 working days on a newly built home—but Victor was up for the challenge. My clients are beyond happy with the seamless experience and grateful for the efficiency that made this process stress-free. I highly recommend Victor for anyone in need of a dedicated and reliable mortgage professional!Posted onTrustindex verifies that the original source of the review is Google. I just refinanced my home and the process was smooth, fast, and stress-free. Victor was professional, responsive, and made everything incredibly easy. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. Victor was truly a pleasure to work with. He demonstrated exceptional availability and expertly recommended the optimal solution for my refinance. His professionalism and depth of knowledge were greatly appreciated. Thank you!Posted onTrustindex verifies that the original source of the review is Google. 21/10 - Incredible, seamless and informative experience with Victor! FYI, We live in Texas, and he's in Cali. Buying or refinancing a home can be stressful since a lot of people don't understand the process and get lost in the paperwork. Victor took the time to get to know us, what we were looking for and provided so much information and practically educated us on 5 different options that would be beneficial for us! He helped us lock in the rates we were absolutely comfortable with and that's more important to a customer! Thank you, Victor for going above and beyond for us.Posted onTrustindex verifies that the original source of the review is Google. We praise God first of all for putting Victor Santos in our life at the right time when we were looking not only to lower our interest rates and monthly payments but also help us to navigate through all the confusion from all the other agents and brokers that just wanted our business.Victor was very patient and humble and honest as he explained all the details and even called us to remind us of incoming e-mails .God continue to keep Victor humble, patient and honest with all his clients. I will recommend Victor to anyone who is looking to refinance their home and property. God Bless Victor and his family always.Posted onTrustindex verifies that the original source of the review is Google. We truly appreciate Victor’s constant availability and how responsive he was every step. No matter the time or day, he was always there to answer our questions and provide clear, honest advice. Thank you again for your dedication and support — we’re so grateful to have worked with you for the 3rd time!Posted onTrustindex verifies that the original source of the review is Google. Victor at OnPoint Mortgage Pro made buying my first home an stress-free experience. He explained everything clearly, kept me updated, and even helped me close a month early. He went above and beyond to secure the best rates and made the whole process seamless. Highly recommend!Posted onTrustindex verifies that the original source of the review is Google. I had an excellent experience working with Victor from OnPoint Mortgage Pro. He met with me and my client, explained the entire funding process, and went above and beyond to research the best program for my client, a first-time homebuyer. Victor not only beat the builder’s in-house lender and the bank on rates, but he also delivered exceptional personalized service. He was always available, highly knowledgeable, and communicated consistently throughout the process. He even shared valuable insights with my client, which was greatly appreciated. Victor managed everything in a timely and transparent way, keeping constant communication with the builder to ensure we stayed on track. Both my client and I were extremely happy with his service. He was thorough, professional, and truly cared about making the experience smooth and stress-free. I highly recommend Victor if you are working with buyers—you will have peace of mind knowing they are in great hands.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Contributed by: Victor Santos NMLS#888844

Onpoint Mortgage Pro NMLS #2134550

Victor Santos is a licensed mortgage loan officer with over 23 years of experience. He has spent many years assisting homeowners and home-seekers in obtaining the optimal solutions for their mortgage needs.

OnPoint Mortgage Pro licensed in:

CA, CO, ID, FL, MD, NH, SC, TX, VA.

NMLS#2134550

We are a licensed professional business in mortgage lending and are committed to providing expert guidance and tailored solutions to help clients achieve their homeownership goals with confidence.